Interest Rate Bank Islam Personal Loan

Alliance bank cashvantage personal financing i profit rate from 4 99 p a.

Interest rate bank islam personal loan. Tenure over 2 years monthly repayment rm458 25. Base rate 2 25 p a. My monthly income is as a.

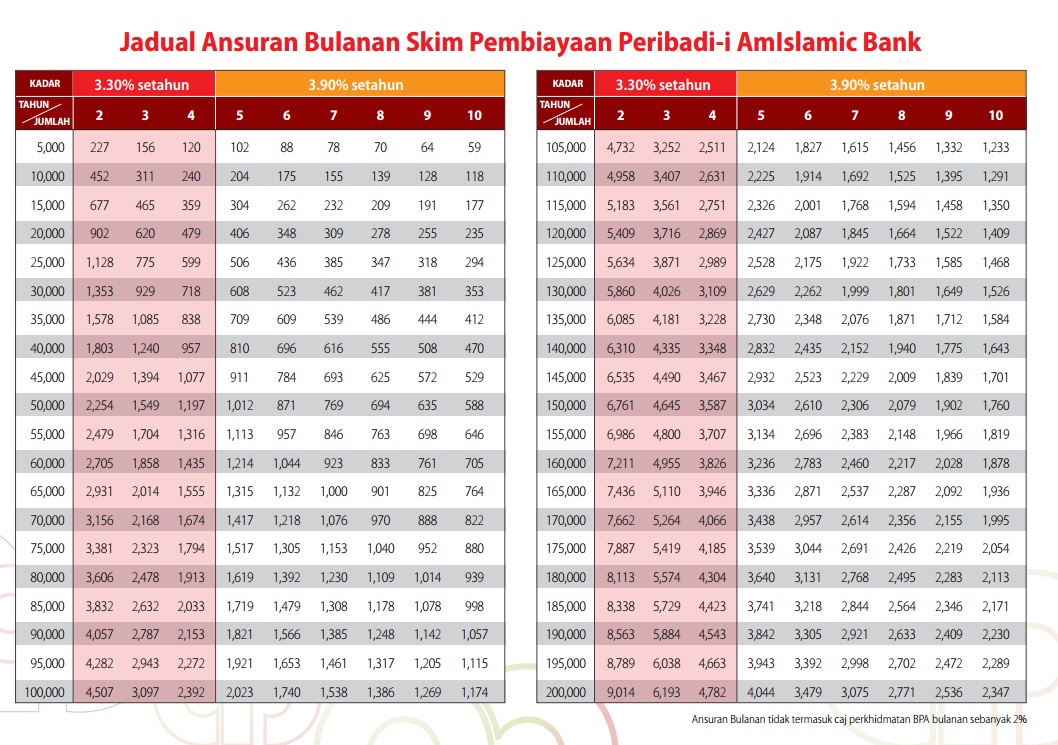

4 to 10 years. Floating interest rates would mean that your loan will be tied up with movements of br with banks. Bank islam s profit rates are also among the highest among islamic banks in malaysia.

It can be confusing because islamic banks claim to not charge interest yet they are charging profit rate. View our flexible monthly instalment table and attractive rates here. Hsbc amanah personal financing i profit rate from 4 88 p a.

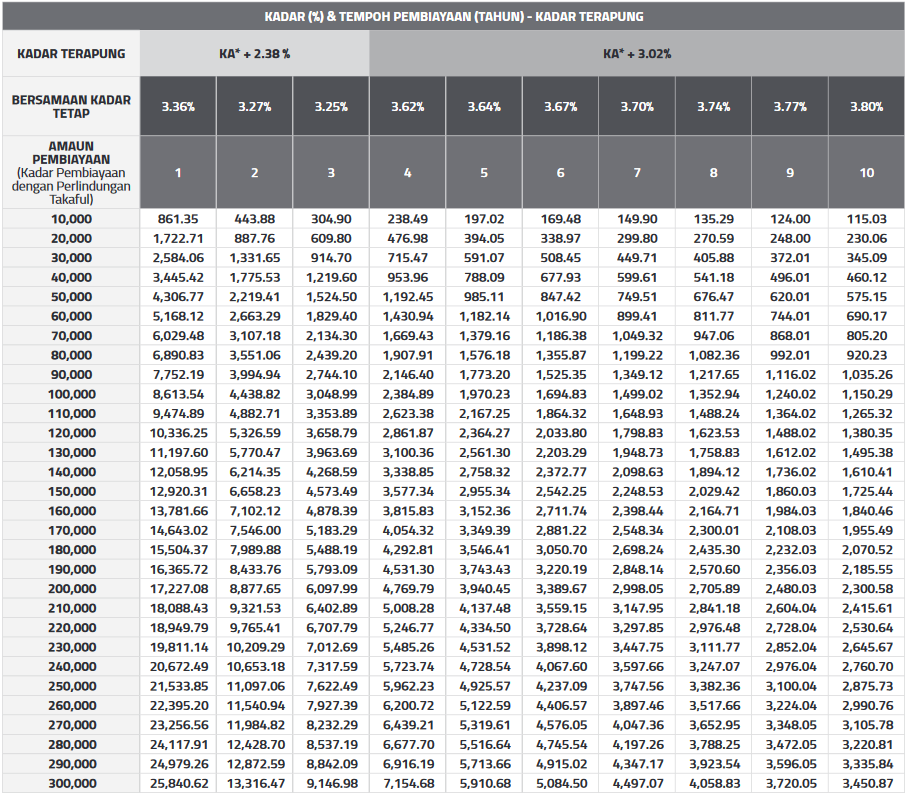

When you take this financing with takaful coverage you ll get to enjoy lower profit rate of 4 99 p a. 1 to 10 years. Kfh murabahah personal financing i profit rate from 6 88 p a.

As long as you are aged between 18 and. Al rajhi personal financing i profit rate from 4 99 p a. It also comes with a minimum income requirement of rm2 000.

Alliance bank cashfirst personal loan interest rate from 4 99 p a. Bank islam cards. However if you opt without the takaful coverage the profit rate is 5 99 p a.

Chances to win exciting prizes. Tenure over 2 years monthly repayment rm495 83. Tenure over 2 years monthly repayment rm457 33.

Tenure over 2 years monthly repayment rm465 67. Enjoy tailored packages to suit your needs. Tenure over 2 years monthly repayment rm474.

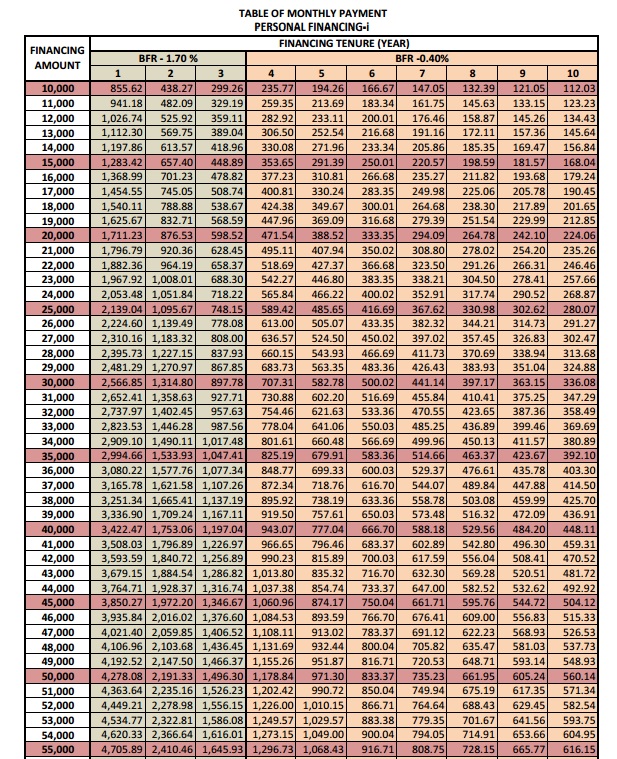

What can i get from bank islam personal loan. Apply bank islam personal loans with low profit rate from 4 03 p a shariah compliant takaful protection rm2k min income loan rm5k 200k for 1 10 years. With bank islam personal financing i package the personal loan comes with an fixed interest rate starting from 4 9 p a.

Base rate 3 15 p a. The margin of financing offered by bank islam reaches up to 90 inclusive of mrtt mortgage reducing term takaful and financing tenure can be extended up to 35 years in accordance to the latest ruling by bank negara malaysia or until aged 70 whichever comes first. Are islamic personal loans interest rate free.

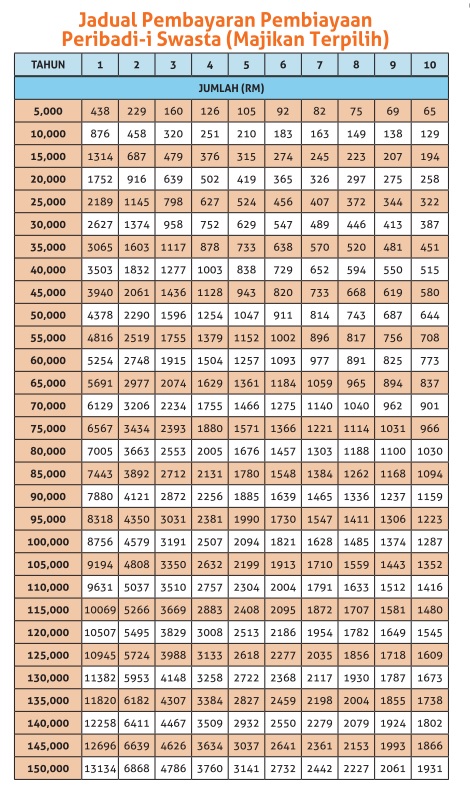

I would like to borrow over. Bank islam personal financing i is a loan package that is offered for public sectors and selected glcs only. So the loan is not available for anyone working in the private sector.

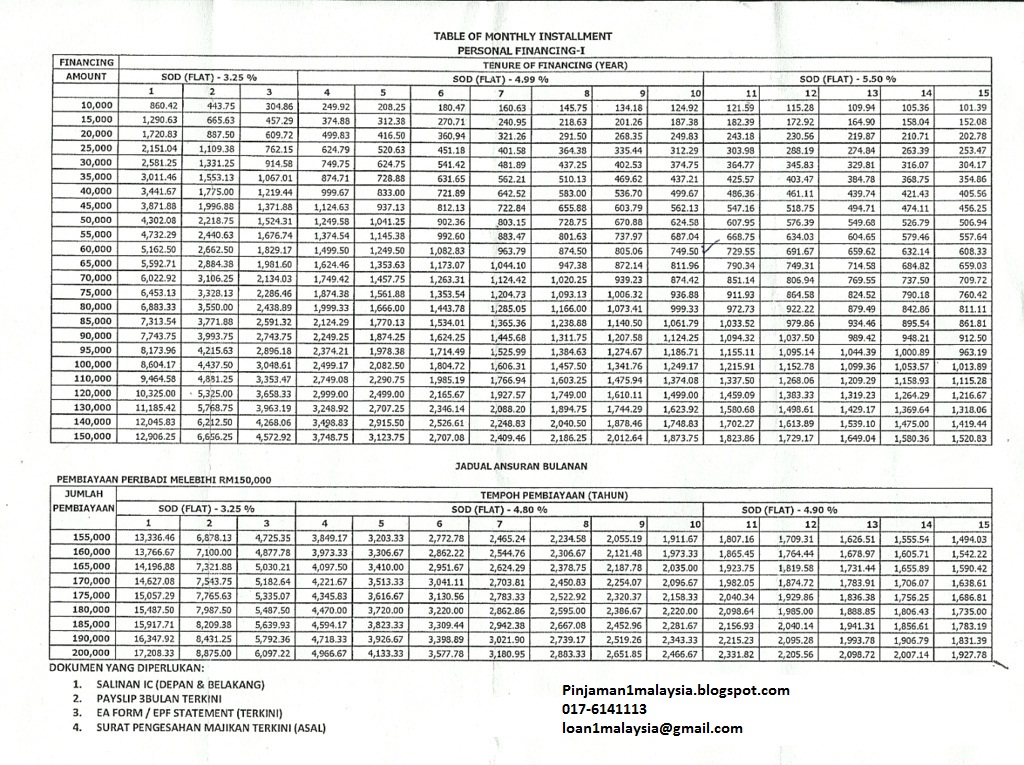

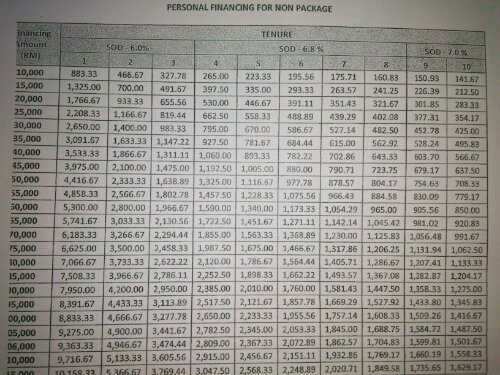

You can apply any amount between rm10 000 to rm300 000 from this islamic personal financing at competitive profit rates calculated on a flat rate basis. This personal loan has a maximum tenure of 10 years. This personal loan has a maximum tenure of 10 years.

Select from all banks. A conventional personal loan is where the bank lends borrowers money with an interest. Citibank personal loan interest rate from 5 88 p a.

1 to 3 years. The major difference between islamic personal loan and conventional personal loan is the way banks makes its profit. It also comes with a minimum income requirement of rm2 000.

With bank islam personal financing i package the personal loan comes with an fixed interest rate starting from 4 9 p a.